2.9 PERFORMANCE ANALYSIS OF THE POŠTA SLOVENIJE GROUP

The Pošta Slovenije Group uses a system of indicators to measure its performance, with regard to the purpose or objective of monitoring. Strategic objectives and indicators (KPIs) are defined to monitor performance in the scope of the SDP, taking into account the BSC methodology, Strategy Maps. Indicators to measure the success of the implementation of risk management measures are used for the CRM process. Profit and cost centres are monitored. The provision of services is monitored via the calculation of costs by business process activity using the fully-allocated cost (FAC) method. The success of marketing is measured using a system of marketing indicators and reports. The performance measurement system is rounded off by various financial statements (income statement, statement of other comprehensive income, income statement by business segment, cash flow statement, statement of changes in equity, statement of financial position, etc.).

2.9.1 Performance analysis of the Pošta Slovenije Group

Income statement of the Pošta Slovenije Group

Table 4: Income statement of the Pošta Slovenije Group

in EUR

2020

2019

Index 2020/2019

Sales revenue

410,694,634

277,857,007

148

Other revenues

16,022,699

5,428,324

295

Operating revenues

426,717,333

283,285,331

151

Historical cost of goods sold

1,570,084

2,742,304

57

Costs of materials and energy

17,916,842

14,056,457

127

Costs of services

165,040,353

76,674,192

215

Labour costs

199,717,426

161,710,361

124

Amortisation/depreciation

26,579,308

19,650,127

135

Other costs

7,968,339

3,260,908

244

Operating expenses

418,792,352

278,094,349

151

OPERATING PROFIT OR LOSS

7,924,981

5,190,982

153

Bargain purchase gain

0

59,951,321

-

Finance income from participation in the profit of subsidiaries, associates and joint ventures

682,782

544,605

125

Finance income

756,569

792,346

95

Finance costs

2,640,124

1,050,300

251

PROFIT OR LOSS FROM FINANCING ACTIVITIES

-1,200,773

60,237,972

-

PRE-TAX PROFIT OR LOSS

6,724,208

65,428,954

10

Current tax

1,131,158

192,668

587

Deferred tax

417,997

-30,777

-

NET PROFIT OR LOSS FOR THE FINANCIAL YEAR

5,175,053

65,267,063

8

Net profit or loss for the financial year attributable to:

- owner of the controlling company

4,516,421

65,532,990

- non-controlling interests

658,633

-265,927

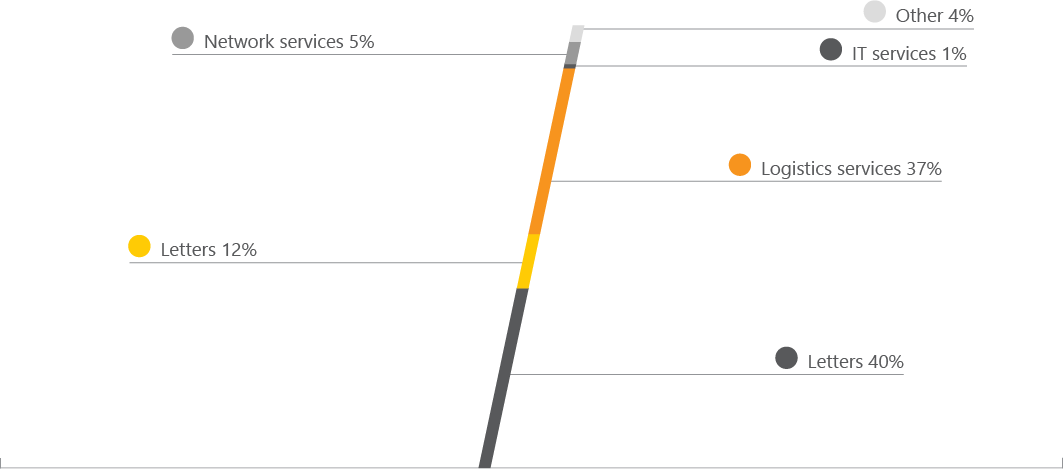

The Pošta Slovenije Group generated EUR 426.7 million in operating revenues in 2020, an increase of 51% relative to 2019. Revenues generated by Pošta Slovenije accounted for 56.4% of the total revenues of the Pošta Slovenije Group.

Graph 4: Breakdown of operating revenues of the Pošta Slovenije Group by segment (in %) for 2020

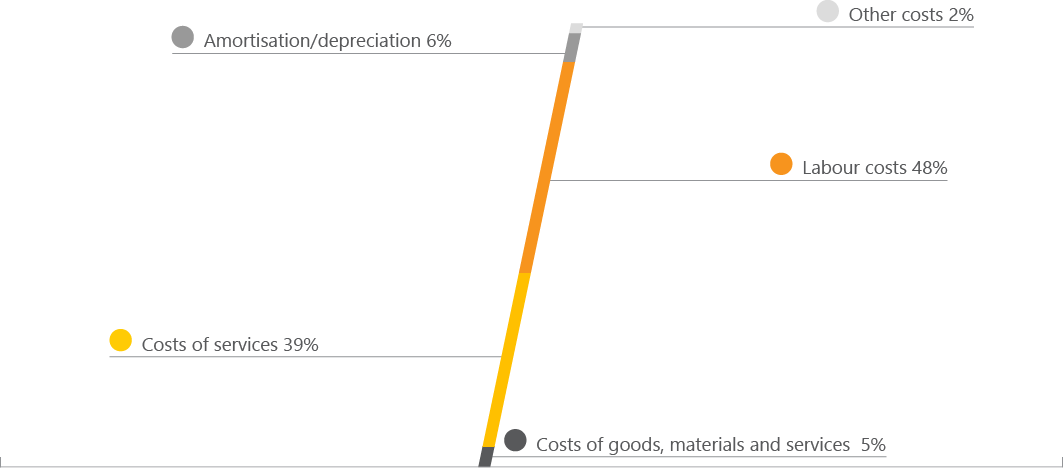

The Pošta Slovenije Group’s operating expenses amounted to EUR 418.8 million in 2020, an increase of 51% relative to 2019. Expenses were up at Pošta Slovenije and at subsidiaries IPPS and APS Plus. The operating expenses of Pošta Slovenije account for 57.4% of the Pošta Slovenije Group’s total operating expenses.

Graph 5: Breakdown of operating expenses of the Pošta Slovenije Group in % for 2020

The Pošta Slovenije Group generated a profit of EUR 5.2 million in 2020, or which EUR 4.5 million was generated by the majority owner (Pošta Slovenije d. o. o.).

Indicators of the Pošta Slovenije Group

Table 5: Performance indicators of the Pošta Slovenije Group

In EUR

INDICATORS

Year

Index 2020/2019

2020

2019

Added value (operating revenues less operating expenses + amortisation/depreciation + revaluation operating expenses + labour costs)

238,004,847

187,168,204

127

Added value as a % of operating revenues

55.8

66.1

Added value per employee (added value divided by the average number of employees based on hours worked)*

32,292

30,822

105

Labour productivity (net sales revenue divided by the average number of employees based on hours worked)**

55,722

57,183

97

Labour costs per employee***

27,097

25,558

106

EBITDA – gross cash flow (operating revenues less operating expenses + amortisation/depreciation + revaluation operating expenses)

38,181,701

25,431,493

150

EBITDA margin as a % of operating revenues

8.9

9.0

EBIT – operating profit (operating revenues less operating expenses)

7,924,982

5,190,982

153

EBIT margin as a % of operating revenues

1.9

1.8

E – net profit

5,175,054

65,267,063

7.9

E – net profit (controlling interest)

4,516,421

65,532,990

6.9

E proportion as a % of operating revenues

1.2

23.0

Overall efficiency (total revenues / total expenses) in %

101.6

123.4

Operational efficiency (operating revenues / operating expenses) in %

101.9

101.9

ROS – return on sales in % (net profit / net sales revenue)

1.1

23.6

ROE – return on equity in % (net profit divided by average equity)

1.4

26.6

ROA – return on assets in % (net profit / average total assets)

0.8

15.4

CAPEX – capital expenditure in % (value of investments / net sales revenue)

1.5

8.2

* for 2019: (Added value of the Pošta Slovenije Group excluding Intereuropa + added value of the Intereuropa Group) / (average no. of employees of the Pošta Slovenije Group excluding Intereuropa + average no. of employees of the Intereuropa Group)

** for 2019: (Net sales revenue of the Pošta Slovenije Group excluding Intereuropa + net sales revenue of the Intereuropa Group) / (average no. of employees of the Pošta Slovenije Group excluding Intereuropa + average no. of employees of the Intereuropa Group)

** for 2019: (Labour costs of the Pošta Slovenije Group excluding Intereuropa + net sales revenue of the Intereuropa Group) / (average no. of employees of the Pošta Slovenije Group excluding Intereuropa + average no. of employees of the Intereuropa Group)

Statement of financial position of the Pošta Slovenije Group

Table 6: Statement of financial position of the Pošta Slovenije Group

In EUR

31. 12. 2020

31. 12. 2019

Index 2020/2019

ASSETS

Non-current assets

393,399,670

401,747,906

98

Intangible assets

5,890,010

5,774,610

102

Property, plant and equipment

340,926,491

346,659,775

98

Investment property

33,160,030

35,185,013

94

Investments in associates

2,694,918

2,558,615

105

Other financial assets

78,283

175,819

45

Financial receivables

475,082

489,399

97

Operating receivables

509,613

624,079

82

Other assets

506,648

609,262

83

Deferred tax assets

9,158,595

9,671,334

95

Current assets

178,711,676

144,122,569

124

Assets held for sale

1,168,520

2,896,592

40

Assets from contracts with customers

11,302,080

7,929,079

143

Inventories

2,250,271

2,045,359

110

Financial receivables

9,603,406

1,010,000

951

Operating receivables

75,250,781

73,918,328

102

Receivables for corporate income tax

215,699

243,492

89

Advances and other assets

1,370,300

5,476,274

25

Cash and cash equivalents

77,550,619

50,603,445

153

Total assets

572,111,346

545,870,475

105

Table 7: Statement of financial position of the Pošta Slovenije Group

In EUR

31. 12. 2020

31. 12. 2019

Index 2020/2019

EQUITY AND LIABILITIES

Equity

325,473,155

329,639,462

99

Non-current liabilities

154,713,603

81,964,023

189

Current liabilities

91,924,588

134,266,990

68

Total liabilities

246,638,191

216,231,013

114

Total equity and liabilities

572,111,346

545,870,475

105

Increase in non-current liabilities due to the long-term loan received – additional drawdown of EUR 30.8 million and loan refinancing at Intereuropa (transfer from the short-term portion).

2.9.2 Performance analysis of Pošta Slovenije d. o. o.

Income statement of Pošta Slovenije

Table 8: Income statement of Pošta Slovenije

In EUR

2020

2019

Index 2020/2019

Sales revenue

240,603,293

236,015,959

102

Other revenues

9,488,586

1,667,512

569

Operating revenues

250,091,879

237,683,471

105

Historical cost of goods sold

467,273

490,148

95

Costs of materials and energy

11,779,101

10,841,299

109

Costs of services

60,196,307

61,412,374

98

Labour costs

154,243,814

142,552,943

108

Amortisation/depreciation

17,934,995

16,366,513

110

Impairment losses on receivables (including the reversal of impairment losses or gains)

-53,300

269,670

-

Other costs

5,393,250

1,955,785

276

Operating expenses

249,961,440

233,888,732

107

OPERATING PROFIT OR LOSS

130,439

3,794,739

3

Finance income from participation in the profit of subsidiaries, associates and joint ventures

3,941,225

641,802

614

Finance income

817,935

512,334

160

Finance costs

1,783,993

718,774

248

PRE-TAX PROFIT OR LOSS

3,105,606

4,230,101

73

Deferred tax

-54,766

73,078

-

Corporate income tax

30,061

0

-

NET PROFIT OR LOSS FOR THE FINANCIAL YEAR

3,130,311

4,157,023

75

Revenues of Pošta Slovenije

Operating revenues are divided into two main categories:

revenues from postal services, and

revenues from other services.

Revenues from other services are further divided into:

revenues from financial services, and

other revenues (sales of merchandise, telegrams, IT services, etc.).

In addition to the net sales revenues referred to above, operating revenues also include capitalised own products and services, revaluation revenues, revenues from subsidies, revenues from the reversal of provisions and accrued costs, compensation received and other revenues.

Graph 6: Breakdown of net sales revenue in 2020

At 88%, revenues from postal services account for the largest proportion of operating revenues, followed by revenues from financial services, the proportion of which is gradually declining.

Pošta Slovenije’s operating revenues were up by 5% in 2020 relative to 2019 to stand at EUR 250.1 million. A total of EUR 7.3 million of operating revenues is accounted for by revenues from subsidies arising from measures to mitigate the effects of the COVID-19 pandemic.

Revenues from letter services were up by 1% relative to 2019 primarily due to the rise in prices, while the growth rate of number of these services was at 89%. The decline in the number of services was primarily the result of the accelerated transition to e-substitutes and reduced economic activity due to the measures implemented to contain COVID-19,

A major decline was recorded in revenues from direct mail and publications. We recorded a sharp decline in revenues in March. April and May due to the measures imposed to contain COVID-19, as postal items were only posted by those companies that operated during this period. After the pandemic ended and economic activity increased, we already recorded slightly increased shipments of unaddressed direct mail (similar quantities than in the same period in 2019) during the summer months, which declined again in autumn. A further decline was also seen during the second wave of the pandemic due to the closure of stores selling non-essential goods.

High, 33% growth was recorded by revenues from parcel services. These increased during the first wave of the pandemic due to measures employed to contain the pandemic and the resulting increase in online purchases (B2C segment). Growth then slowed gradually but rose again significantly during the second wave. The proportion of total net sales revenue accounted for by the aforementioned services was also up.

Revenues from logistics services are falling due to the transfer of car logistics services to the subsidiary PS Logistika and decline in revenue due to the COVID-19 pandemic.

Further decline in revenues from financial services was a result of the expected transition to other forms of payment, the alternative payment locations offered by other payment transaction providers, the points of sale of individual invoice issuers and transition to the cash on delivery without payment service; there were significantly less payments via payment orders due to the extraordinary situation connected with the containment of the consequences of the coronavirus.

Revenues from the sale of merchandise and games of chance are within expectations, otherwise seeing a minor decline in most services, which is the result of less visits to post offices due to the extraordinary situation connected with the containment of the consequences of the coronavirus, where services have not been provided for our partners for some time now. An additional unplanned decline relative to 2019 was the result of the fact that most post offices were not open on Saturdays, Due to the restriction on movement (lockdown) the number of posted telegrams increased, with higher proceeds from the sale of letter and parcel packaging, the prices of which rose at the beginning of the year, as well as a higher sale of office supplies.

Revenues from IT services were up from cloud computing and e-archiving services.

Pošta Slovenije received EUR 7.3 million in revenues from subsidies arising from measures to mitigate the effects of the COVID-19 pandemic.

Revaluation revenues were up in 2020 from the sale of the commercial building in Kranj.

Finance income was up relative to 2019 on account of financial revenues from participating interests in the Group (received dividends from subsidiaries PS Logistika, EPPS and PS Moj paket).

Expenses of Pošta Slovenije

Pošta Slovenije’s operating expenses in 2020 were up 7% relative to 2019 to stand at EUR 250 million. At 62%, labour costs account for the highest proportion of operating expenses, followed by the costs of services, and amortisation and depreciation costs.

Graph 7: Breakdown of operating expenses at Pošta Slovenije

Costs of materials were up relative to 2019. This was mostly attributed to higher costs from the purchase of protective materials due to the COVID-19 pandemic (face masks, gloves and hand sanitisers), and the purchase of tyres and maintenance material.

Energy costs were lower in 2020 on account of lower motor fuel prices, primarily at the beginning of the year, and lower electricity costs.

Primarily the following items were down relative to 2019 within the costs of services:

costs of student labour via student services – lower costs due to the fact that the measures associated with COVID-19 required student work to be completely suspended when permanent employees were on furlough. The number of hours of student labour rose again at the end of the year due to the increased workload.

costs of contracted transportation services – the planned additional logistics services were not implemented completely, certain transportation services (mostly tied to logistics services) were reorganised, additional transportation services were carried out in-house, as well as a smaller number of additional transportation services;

reimbursement of costs for the use of mopeds and bicycles for business purposes – the reason for lower costs lies in the termination of contracts for the use of bicycles and the resulting cancellation of the payment of lump sums or fees;

lease costs – there are less leases of cars or property, plant and equipment, with forklifts also no longer being leased.

The following factors had an effect on higher labour costs in 2020:

agreement with trade unions as a result of the strike demands from November 2019, based on which a separate bonus was paid out in 2020 for employees working in transportation, and the Executive Management’s resolution of 20 December 2019 that also approved a bonus for employees in business unit support services;

increase in the average number of employees;

payment of a crisis bonus of EUR 3.1 million arising from measures to mitigate the effects of the COVID-19 pandemic;

payment of a one-time monetary bonus to all employees for presence at work in November 2020 due to work in adverse conditions and due to an increased volume of work in the amount of EUR 1.8 million (gross II) or EUR 255 (gross I) per employee on average;

financial remuneration of employees for permanent presence at work in order to minimise absenteeism in November and December; and

payment of performance bonuses in the amount of EUR 1.6 million in 2020.

Revaluation operating expenses are higher than in 2019 due to an impairment of property, plant and equipment.

Finance costs were up in 2020 due to the expenses from loans received from banks.

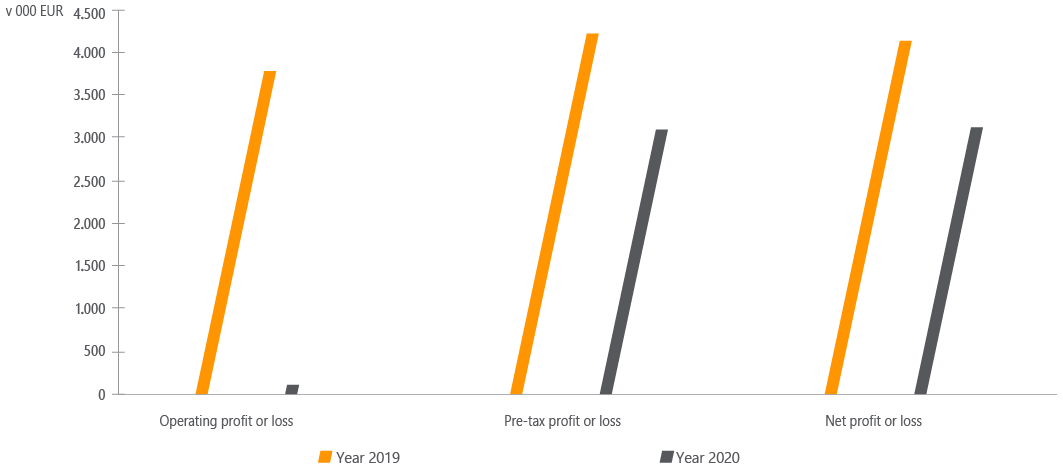

Net profit or loss of Pošta Slovenije

Since March 2020 the COVID-19 pandemic affected all the segments of Pošta Slovenije’s performance, with the largest decline in services and revenues seen in the area of letter mail, while the Company recorded growth in the area of parcel services. Growth in revenues from parcel services compensated for the entire loss in revenues in all other business segments at the end of the year. Growth in labour costs as the result of fulfilment of the agreement with trade unions also had an effect on Pošta Slovenije’s performance.

Despite the hindered operations, Pošta Slovenije ended 2020 with a profit of EUR 3.1 million, a decrease of 25% relative to 2019.

Graph 8: Profit or loss of Pošta Slovenije (in thousand EUR)

Performance indicators of Pošta Slovenije

Table 9: Performance indicators of Pošta Slovenije

In EUR

INDICATORS

Year

Index 2020/2019

2020

2019

Added value (operating revenues less operating expenses + amortisation/depreciation + revaluation operating expenses + labour costs)

175,386,162

163,152,298

107

Added value as a % of operating revenues

70.1

68.6

Added value per employee (added value divided by the average number of employees based on hours worked)

31,828

29,932

106

Labour productivity (net sales revenue divided by the average number of employees based on hours worked)

43,663

43,300

101

Labour costs per employee

27,991

26,153

107

EBITDA – gross cash flow (operating revenues less operating expenses + amortisation/depreciation + revaluation operating expenses)

21,036,628

20,573,006

102

EBITDA margin as a % of operating revenues

8.4

8.7

EBIT – operating profit (operating revenues less operating expenses)

130,439

3,794,739

3

EBIT margin as a % of operating revenues

0.1

1.6

E – net profit

3,130,312

4,157,023

75

Net profit (E) as a % of operating revenues

1.3

1.7

Overall efficiency (total revenues / total expenses) in %

101.2

101.8

Operational efficiency (operating revenues / operating expenses) in %

100.1

101.6

ROS – return on sales in % (net profit / net sales revenue)

1.3

1.8

ROE – return on equity in % (net profit divided by average equity)

1.4

1.9

ROA – return on assets in % (net profit / average total assets)

0.9

1.3

CAPEX – capital expenditure in % (value of investments / net sales revenue)

7.5

8.4

Statement of financial position of Pošta Slovenije

Table 10: Statement of financial position of Pošta Slovenije – assets

In EUR

As at 31 December 2020

Proportion in %

As at 31 December 2019

Proportion in %

Index 2020/2019

ASSETS

363,130,204

100.0

326,469,033

100.0

111

Non-current assets

238,380,756

65.6

234,072,707

71.7

102

Intangible assets

1,341,566

0.4

570,527

0.2

235

Property, plant and equipment

174,894,305

48.2

177,289,301

54.3

99

Investment property

7,459,240

2.1

8,337,887

2.6

89

Investments in subsidiaries

50,875,151

14.0

44,162,778

13.5

115

Investments in associates

111,009

0.0

111,009

0.0

100

Other financial assets

48,935

0.0

53,819

0.0

91

Financial receivables

422,111

0.1

421,441

0.1

100

Operating receivables

264,212

0.1

369,941

0.1

71

Other assets

477,093

0.1

426,144

0.1

112

Deferred tax assets

2,487,134

0.7

2,329,860

0.7

107

Current assets

124,749,448

34.4

92,396,326

28.3

135

Assets held for sale

754,679

0.2

195,592

0.1

386

Assets from contracts with customers

10,785,400

3.0

7,396,079

2.3

146

Inventories

1,616,990

0.4

1,393,750

0.4

116

Financial receivables

7,300,000

2.0

0

0.0

0

Operating receivables

42,263,933

11.6

39,438,066

12.1

107

Advances and other assets

943,676

0.3

5,093,216

1.6

19

Cash and cash equivalents

61,084,770

16.8

38,879,623

11.9

157

Total assets were up by 11% as at 31 December 2020 relative to the situation at the end of 2019. At 48.2%, property, plant and equipment still account for the highest proportion of total assets.